Council tax explained

How will this affect you?

We are doing everything we can to balance our budget, make efficiencies and work with the Government for a fairer deal for Lewisham, but without raising council tax we won’t have the money to fund the important services we all need and value, like community safety, parks, libraries, leisure centres, youth services and waste collection services.

To keep these services going, we are increasing council tax by 4.99%.

In Lewisham average Band D properties will pay about £1.87 extra per week. The Mayor of London is also increasing his element of council tax , meaning in total, average bills will go up by just over £8 a month.

Lewisham has a history of strong financial management, and we remain focused on doing everything we can to balance our budgets while continuing to provide vital services. We will also continue to make Lewisham’s voice heard and lobby the Government for a fair deal and an overhaul of how councils are funded.

We are proud of the work we do that we know makes a difference to those who need it most, from free school meals so no child goes hungry during school holidays, to making sure our warm welcomes are available all over the borough, to strengthening our jobs and skills offer, especially for our young people.

While we tackle the budget challenges head on, we are ambitious about our future and look forward to delivering projects, including our Lewisham Town Centre improvements, bringing youth services back in house, campaigning for the Bakerloo extension and rolling out Family Hubs so families can get all the support they need in one place locally.

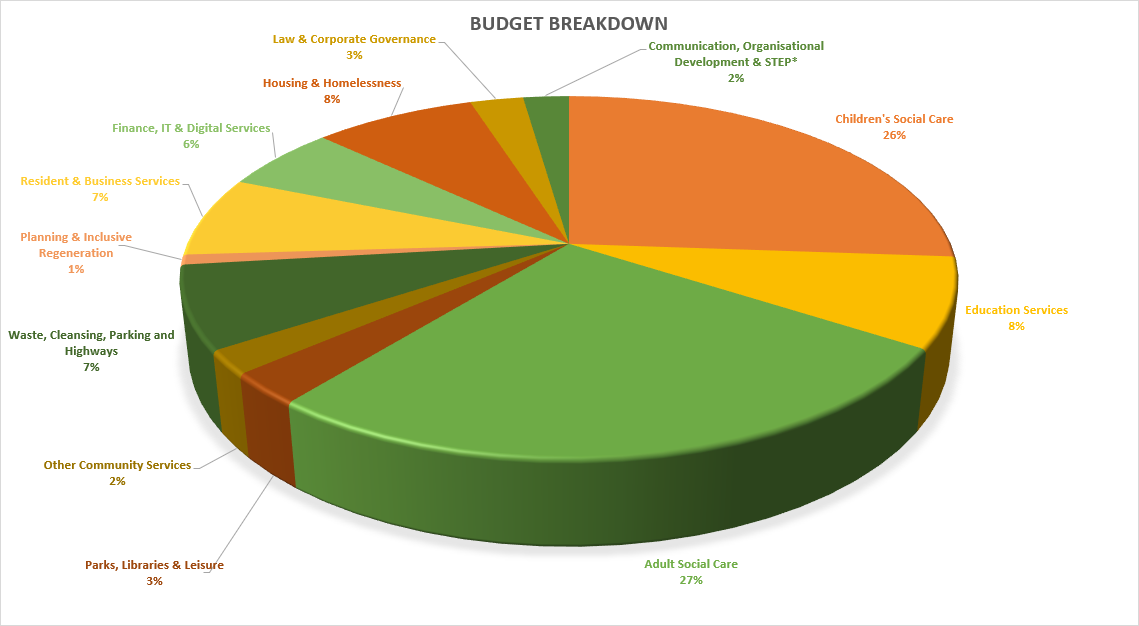

How do we spend our budget?

What does your council tax go towards?

- 17 million bins collected which equals 81,000 tonnes of waste (that’s nearly 7,000 London red buses)

- maintenance of over 1,200km of roads and pavements

- supporting 5,000 adults through adult social care, receiving 23,388 calls and providing 846,779 hours of homecare support

- supporting over 400 children in care and care leavers as they transition through to adulthood

- maintenance of our 47 parks and green spaces and retained our Green flags status

- 11 libraries with books, employment support, and digital access, which are visited nearly 1 million times a year

- we have worked with Lewisham Local and our VCS partners to provide 45 warm spaces across the borough

- nine Family Hubs supporting hundreds of families

Help paying your council tax

We are doing everything we can to support those who may find it difficult to pay. We are continuing to invest in our council tax reduction scheme, so if you’re worried about paying your council tax, please speak to us – as support may be available.

We also have several resources available from our online support page.

If your financial situation has changed recently you may also be eligible for other support.

How are councils funded?

Councils are funded through a combination of business rates, central Government grants and your council tax. We also generate income through one off grants, rents and investments. The council’s budget for 2025/26 was approved by Full Council on Wednesday 5 March.

In Lewisham, council tax raised locally to fund services (rather than being funded by Government, which has decreased) has increased to £152m and now represents about 49% of our budget compared to 29% in 2014. This comes on top of the £254m of cuts that this council has been forced to make since 2010 due to less Government funding every year.

While the local government finance settlement announced in December was an improvement on what we have been allocated in the past, there is still a way to go to meet the budget shortfall and make the savings we need to.

What are the pressures?

Councils across the country are feeling the impact, but especially those in London, where we face a combined shortfall of over £500m next year.

Housing and social care services remain our biggest costs, combined they account for 71% of our budget. The housing crisis has seen nearly 3,000 households come to the Council as they can no longer afford to rent in the private sector. Our temporary accommodation costs have increased by £12m despite the Council doubling the budget for this service in the current year. The cost of supporting children with social care has increased from £69m to £79m. Likewise, the cost of supporting adult social care needs has also increased significantly.

Read the details in our budget report.